Finances

Why invest

Business critical SaaS solutions

Our passion is to simplify business for construction companies

SmartCraft aims to streamline operations for construction companies in Norway, Sweden and Finland, especially small to medium enterprises, by freeing up time typically spent on administrative tasks. Our specialized SaaS solutions caters to both small and large companies, recognizing the commonality of processes in the field and office. Efficient processes will be essential for craftsmen and contractors to stay competitive in the future.

Our solutions, integrated into the sales process, enable customers to be more efficient and precise in their offers. With increasing regulatory requirements, our software helps in meeting health, safety, and quality control standards.

Despite the construction industry’s low digitization, we anticipate rapid change, emphasizing the need to adopt digital processes to avoid being left behind.

Best-of-breed solutions

We offer tailor-made software solutions designed specifically for various niches within the construction industry. Since our establishment in 1987, we’ve prioritized understanding our customers’ unique needs. This way we have the best solutions for plumbers, carpenters and electricians who have different needs and workflows. We have deep knowledge and insight into the business models of our customers and collaborate cross solutions to create synergies in development and sales.

Our goal is to continually provide efficient solutions by investing about 10% of our revenue into product and technology development in 2024.

Our software is accessible seamlessly on smartphones, tablets, and desktops, enabling users to manage tasks from producing quotations to project documentation and invoicing, whether they’re in the office or on-site.

Massive market and low take-rate

In our current markets, there are approximately 260,000 companies in the construction industry. As a market leader, we serve 12,500 customers, indicating low market penetration, mainly consisting of SMEs where our solutions are well-suited. Calculations suggest the potential market size exceeded NOK 10 billion in the Nordics alone in 2021, with double-digit annual growth expected from 2020 to 2025.

We are dedicated to maintaining our leading position in the industry. Our cloud-based solutions are easy to implement, ensuring a seamless purchase decision for new customers. Despite the low monthly cost for new SmartCraft customers, the return on investment is significant.

Attractive business model

SmartCraft has a history of profitable growth, driven by our cloud-based Software-as-a-Service model. Adding new customers or users incurs minimal costs, coupled with a highly efficient sales and marketing setup and a gross margin exceeding 90%. We aim for organic revenue growth of 15-20% in the medium term and anticipate increasing EBITDA margins due to business scalability.

Our continuous investment in product development ensures future growth while maintaining a focus on high margins. Our business model offers long revenue visibility and low churn rates, minimizing cash flow risks. With a flexible approach, we generate cash consistently every quarter and year.

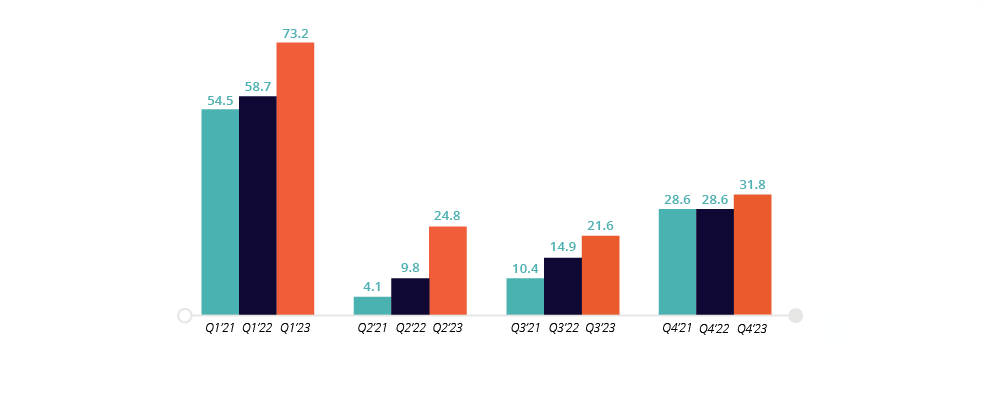

Increasing cash generation from operating activities, MNOK

High quality of earnings

We prioritize simplicity for our customers, focusing on providing digital solutions for business control. In the fourth quarter, 97% of our revenue was recurring, ensuring a stable financial profile with minimal risk.

We achieve this through a strategy of minimizing non-recurring revenue such as setup and installation fees, consulting, training, and support fees, emphasizing user-friendly software and leaving hardware and third-party software to specialized vendors. This approach ensures high earnings quality, visibility, and low operational risk.

Focus on electro and plumbing companies in the renovation sector

SmartCraft primarily serves small and medium enterprises (SMEs) involved in renovation, upgrades, services, and maintenance of existing buildings, with a focus on electrician and plumbing companies. This strategic focus, coupled with the demand for energy-efficient solutions, provides stability in a challenging market.

While the customer mix in Finland differs, we aim to increase SME concentration and reduce dependence on new projects by expanding into Norway and Sweden. Operating in an underpenetrated market, where most SMEs lack comprehensive digital solutions for project management, presents significant untapped potential for both the industry and SmartCraft.

Continued M&A ambitions with strong M&A track record

In the period 2017-2023, we completed ten successful acquisitions, focusing on complimentary or best-in-class solutions in new markets. These acquired companies act as platforms for cross-selling our existing services.

Our proven M&A process involves identifying targets, integrating solutions, and leveraging synergies for growth. We currently have a significant M&A pipeline with ongoing discussions in double digits. Maintaining capital discipline and avoiding overpayment are our top priorities.

Contact us